Download the accompanying IPython Notebook for this Tutorial from Github.

Python streamlines tasks requiring multiple steps in a single block of code. For this reason, it is a great tool for querying and performing analysis on stock ticker data.

Last post, we outlined steps for calculating Bollinger Bands.

In this post, we introduce a new technical indicator, Price Channels.

Price Channels

Price Channels are lines set above and below the price of a security. The upper channel is set at the x-period high and the lower channel is set at the x-period low. For a 20-day Price Channel, the upper channel would equal the 20-day high and the lower channel would equal the 20-day low.

Price Channels can be used to identify upward thrusts that signal the start of an uptrend or downward plunges that signal the start of a downtrend. Price Channels can also be used to identify overbought or oversold levels within a bigger downtrend or uptrend.

Price Channels are calculated as follows:

Upper Channel: 20-day high Lower Channel: 20-day low

Let’s use Python to compute Price Channels.

1. Import modules.

import pandas as pd

import pandas.io.data as web

import matplotlib.pyplot as plt

%matplotlib inline

2. Define function for querying the daily high.

def get_high(stock, start, end):

return web.get_data_yahoo(stock, start, end)['High']3. Define function for querying the daily low.

def get_low(stock, start, end):

return web.get_data_yahoo(stock, start, end)['Low']

4. Define function for querying daily close.

def get_close(stock, start, end):

return web.get_data_yahoo(stock, start, end)['Adj Close']5. Query daily high, daily low, and daily close for ‘FB’ during 2016.

x = pd.DataFrame(get_high('FB', '1/1/2016', '12/31/2016'))

x['Low'] = pd.DataFrame(get_low('FB', '1/1/2016', '12/31/2016'))

x['Close'] = pd.DataFrame(get_close('FB', '1/1/2016', '12/31/2016'))

6. Compute 4 week high and 4 week low using rolling max/min. Add 50 day simple moving average for good measure.

x['4WH'] = pd.rolling_max(x['High'], 20)

x['4WL'] = pd.rolling_min(x['Low'], 20)

x['50 sma'] = pd.rolling_mean(x['Close'], 50)

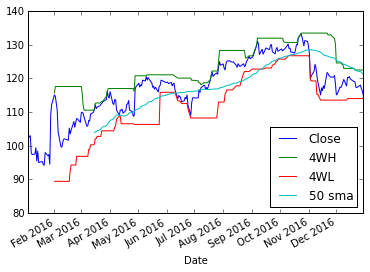

7. Plot 4WH, 4WL, 50 sma, and daily close.

x.plot(y=['4WH', '4WL', '50 sma', 'Close'])

There you have it! We created our Price Channels. Here’s the full code:

import pandas as pd

import pandas.io.data as web

import matplotlib.pyplot as plt

%matplotlib inline

def get_high(stock, start, end):

return web.get_data_yahoo(stock, start, end)['High']

def get_low(stock, start, end):

return web.get_data_yahoo(stock, start, end)['Low']

def get_close(stock, start, end):

return web.get_data_yahoo(stock, start, end)['Adj Close']

x = pd.DataFrame(get_high('FB', '1/1/2016', '12/31/2016'))

x['Low'] = pd.DataFrame(get_low('FB', '1/1/2016', '12/31/2016'))

x['Close'] = pd.DataFrame(get_close('FB', '1/1/2016', '12/31/2016'))

x['4WH'] = pd.rolling_max(x['High'], 20)

x['4WL'] = pd.rolling_min(x['Low'], 20)

x['50 sma'] = pd.rolling_mean(x['Close'], 50)

x.plot(y=['4WH', '4WL', '50 sma', 'Close'])

In celebration of completing this tutorial, let’s watch Ed Seykota sing ‘The Whipsaw Song’.